DRAFT DOCUMENT -- SUBJECT TO REVISION AND REVIEW

A Proposed Model for Structuring a Diocese and its Parishes

Back to jgray.org homepage

Click here and to save this document as a Microsoft Word file.

Prepared by Fr. Jason Gray, December 7, 2005

Copyright © 2005 by Fr. Jason Gray

All rights reserved

Other persons are permitted to copy, distribute, or display this work with the following provisions: Reproduction of this work must contain proper attribution to the author. No reproduction of this work is allowed for commercial purposes. This text may not be used to produce a derivative work, whether by altering, transforming, or building on this text. Other permissions to copy, distribute, display, or reprint this work require the expressed permission of the author. This document is cited as follows:

Gray, Jason A., Proposed Model for Structuring a Diocese and its Parishes; available from https://www.jgray.org/docs/structuring.html; Internet; accessed 1 January 2006.

In the United States, there is ample evidence that dioceses should avoid the corporation sole or sole proprietorship model when structuring themselves.

A corporation aggregate model is preferred.

However, even if this model is adopted, there is a danger in our litigious society that a person seeking financial damages from a diocese might try to acquire the assets of parishes or other institutions in a diocese.

In discussions with a group of legal and canonical experts, there are several ways in which the assets of parishes and diocesan institutions can be protected from the legal argument of "piercing the corporate veil."

In presenting these observations, a model will be proposed for structuring a diocese, its parishes and institutions.

The model presented is not the only way to address these questions.

This model must be adapted to local circumstances and must take into account the applicable state law that governs the civil incorporation of religious organizations for each diocese.

These observations will be divided into general observations about any juridic person subordinate to a diocese, and specific observations about specific juridic persons.

GENERAL OBSERVATIONS

First and foremost, the separate incorporation of the individual parishes and institutions of a diocese is paramount.

Insofar as possible, each separate civil corporation should be canonically established as a juridic person, and each juridic person should be civilly established as a separate corporation.

The separate incorporation is accomplished according to the requirements of state law.{1}

The status of a juridic person is conferred either by the law itself (for a parish as in canon 515 §3) or by a decree of the diocesan bishop (for a diocesan school or another diocesan entity as in canon 116 §2).

The clear separation, canonically and civilly, helps minimize any confusion or lack of clarity about the status of each parish or other entity in a diocese.

Secondly, the statutes of each institution (juridic person) should be carefully reviewed.

The circumstances that have exposed a company to the risk of piercing the corporate veil have included:

two corporation that share the same name; two corporations that have the same board of directors; two corporations with nearly identical statutes; two corporations that are under the ultimate authority of the same person; two corporations with co-mingled assets or whose assets are used for the same purpose.

The fundamental legal issues in a "piercing" case is the question of control.

The following principles should govern the incorporation and the statutes of a parish, a diocesan school, or another entity:{2}

Statutes

- Each independent public juridic person should have its own statutes (c. 117).

Those statutes should be unique and tailored to the juridic person.

- Cookie-cutter statutes may open the door to an argument that—in spite of the separate statutes—the juridic person is really controlled by the superior entity.

The greater the dominating control, the less the inferior juridic person is really thought of as separate and independent.

- Statutes for a civil corporation in a diocese should not hesitate to use canonical language and to make references to the Code of Canon Law.

Accurate canonical language will avoid the confusion that can arise when trying to translate civil terms into canonical terms and vice versa.

- Public juridic persons must incorporate the contents of canons 1291-1294 on alienation into their statutes in virtue of canon 1295.

The statutes must define acts of extraordinary administration in accord with canon 1281.

The statutes should also define acts of ordinary administration of greater importance in the sense of canon 1277.

- Statutes should make an explicit claim of ownership of assets by the juridic person.

This is especially necessary if there may be doubt about who owns certain assets.

In any case, the ownership of a subordinate juridic person should not rest with the diocese or the diocesan bishop.

Considerations in state law

- In each diocese, state law must be examined to determine the requirements for a civilly valid act.

- In some states, one document may suffice for both the civil by-laws or statutes and the ecclesiastical statutes.

If two documents are necessary, both documents should incorporate the principles listed here.

- The ownership of assets should be carefully considered with respect to state law.

In some states, it may be best for the assets to be held by the parish corporation.

In other cases, it may be better to hold the assets of the parish in trust on behalf of the parish.

Even so, if the assets are held in trust by the diocesan bishop, this situation is practically equivalent to a corporation sole model which is to be avoided as much as possible.

Some definitions

- For the purposes of this section, the "board of directors" shall refer to those persons responsible under civil law for governing a civil corporation.

- The "administrator" shall refer to the person who governs the temporal assets of the corporation under civil law.

The administrator should generally be the same person who represents the juridic person under canon law and acts in its name (c. 118).

This administrator would also generally have the right to administrate the temporal goods of the juridic person under canon law (c. 1279 §1).

- The "local level" shall refer to those persons who are members of the corporation (under civil law) or the juridic person (under canon law), or who work closely with it.

In any case, the "local level" shall never refer to the diocesan bishop, the vicar general, or any diocesan official.

Local control

- Control over the juridic person and its assets should, as much as possible, be independent from the diocesan bishop.

- Any corporate action and any juridic act should, as much as possible, originate on the local level.

The action should generally begin with the free initiative of the local level and be circumscribed when necessary by the required consent of the higher level.

- The consent of the diocesan level is required for acts of extraordinary administration (c. 1281) and certain acts of alienation (cc. 1291-1294).

Diocesan control

- Certain exceptional matters require that the statutes explicitly recognize the competence of the diocesan bishop to initiate an action, even against the wishes of the local level.

Some of these circumstances include the ability to create,{3} suppress,{4} and tax{5} a public juridic person in accord with the norm of law.

In some circumstances, the diocesan bishop may also need to retain the right to appoint and remove an administrator in accord with the norm of law.{6}

Any other prerogatives which must be retained by the diocesan bishop should also be explicitly included.

- The juridic person must acknowledge the competence of the diocesan bishop to intervene in religious matters of faith and morals (c. 392).

However, as much as possible, the prerogatives of the diocesan bishop to exercise direct control over corporate action or financial matters should be limited to what is absolutely essential.

Local officials

- A majority of the members of the "board of directors" of a corporation should be local and drawn from the membership of the juridic person.

- The power to nominate members of the "board of directors" should rest, as much as possible, on the local level.

If it is desired, the confirmation of a nominated board member may rest on the diocesan level.

- The administrator should be a person on the local level.

- If it is possible, the nomination of the administrator should be left to the local level while the confirmation of the administrator may rest with the diocesan level.

- In some cases, it is the right of the diocesan bishop in law to appoint the administrator.

In these cases, this prerogative cannot be eliminated, nor should it.

- The terms of office for each board member should be specified.

Some board members will not have a term of office because they hold office indefinitely.

- As much as possible, the hiring of employees should be done on the local level.

If the diocese is involved in the hiring of an employee, the diocese may inherit a legal liability if a suit is later brought for negligent hiring or negligent supervision of an employee.

Even so, the diocese should consider with legal counsel what policies should govern the hiring of staff to avoid this liability.

Ordinary and extraordinary administration

- Statutes should clearly delineate the difference between acts of ordinary and extraordinary administration.

Ordinary administration may be handled by the administrator on the local level.

Extraordinary administration may require seeking the counsel of other persons and always requires seeking the consent of the ordinary.

The consent of the ordinary is for the validity of the transaction.{7}

- It is possible to introduce a third level in the hierarchy of acts of administration:

acts of ordinary administration of greater importance.

These actions can require the seeking the counsel of other persons, but do not require the consent of the ordinary.{8}

- An act of ordinary administration of greater importance is not automatically considered invalid if the required counsel is not sought.

If it is important for this counsel to be sought for the validity of the action, this requirement must be expressly stated to be for validity (c. 10).

The threat of invalidity should only be imposed for a serious matter.

- This leads to three types of transactions:

- Acts of ordinary administration:

These acts are placed by the administrator.

- Acts of ordinary administration of greater importance:

These acts require the counsel of other members of the board.

- Acts of extraordinary administration:

These acts may require the counsel or consent of the members of the board.

Even so, these acts always require the consent of the ordinary.

SPECIFIC OBSERVATIONS

I.

Parishes and Missions

Parishes should be separately incorporated and should have their own statutes which are tailored to their specific situation.

The general observations made above should be applied to a parish with the following adaptations:

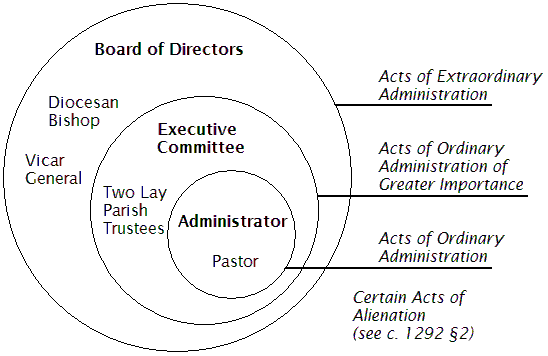

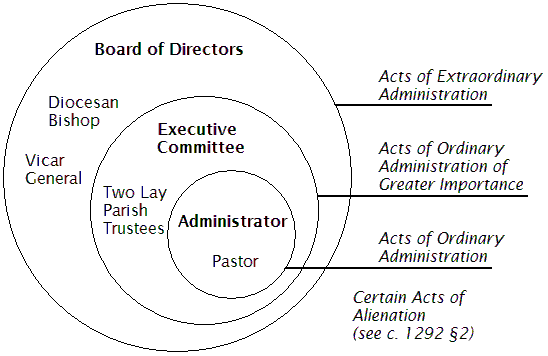

Parish corporate structure

Parish corporate structure

- The "board of directors" should have an "executive committee" on the local level that carries out the ordinary acts of administration for the parish.

Acts of extraordinary administration should be reserved to the full board.

- The executive committee should be composed of the pastor and two lay trustees who are nominated by the pastor from among the parishioners.

Although this is not necessary, the diocesan bishop may reserve the right to approve the selection of trustees.

- The board of directors should include the diocesan bishop and the vicar general, in addition to the members of the executive committee.

The diocesan bishop or at least the vicar general must give consent before any act of extraordinary administration is validly placed.

- Although rare, the Apostolic See has a role of oversight in certain acts of alienation (c. 1292 §2).

- According to this model, the majority of the board members are on the local level (three to two).

The two lay trustees are nominated by the pastor on the local level, but the pastor is appointed by the diocesan bishop (c. 523).

The prerogative of the diocesan bishop to appoint, transfer, and remove the pastor according to the code must not be compromised.

Although the pastor is appointed by the diocesan bishop, it can still be argued that the pastor is a "local" officer.

He serves locally and his primary focus is on the local needs of the parish.

He does not work out of the chancery, nor is he bound to act according to the mind of the bishop, like the vicar general (c. 480).

- If a different model is used, the local officers should still outnumber the diocesan officials.

Officers of the corporation

- The statutes should specify that the diocesan bishop, vicar general, and pastor are members of the board of directors by office.

- In some states, the law governing religious organizations may provide for members to be elected or appointed.

Therefore, the lay trustees should be members by appointment or election, depending on state law.

- If the trustees are appointed, the pastor should have the right to nominate them.

If the diocesan bishop wishes, he may reserve the right to approve the nomination of the trustees.

It is not necessary for the diocesan bishop to reserve this right.

- If the trustees must be elected according to the provisions of state law, the election does not need to be a parish-wide election in which all parishioners are eligible to vote and eligible to be elected.

For such an important role as a lay trustee, it might be better to limit those who are eligible candidates and eligible to vote to an active parish body such as the finance council or the pastoral council.

The pastor might even retain the right to reject a nominated candidate whom he felt was unqualified before any vote is conducted.

- The length of the term for each officer should be specified.{9}

The statutes should specify the length of a lay trustee's term and the maximum number of terms a trustee may continuously serve.

- The manner in which an officer is removed should be specified, especially for the trustees.{10}

The statutes should make some provision for the trustees to be removed for a grave cause either by an action of the pastor with the right of recourse to the diocesan bishop, or by an action of the diocesan bishop for a most grave cause.

Actions of the executive committee

- The statutes should require that any corporate action must originate from the executive committee which is chaired by the pastor.

The executive committee cannot act apart from the pastor, who is the administrator of the temporal assets of the parish (c. 532).

- The pastor may execute any acts of ordinary administration.

With respect to civil law, the pastor may undertake these actions on his own authority.

- The pastor may execute any acts of ordinary administration of greater importance only after consulting with the two lay trustees on the executive committee.

For certain actions, the advice of the trustees may be required for validity.{11}

With respect to civil law, these actions are undertaken by a meeting of the executive committee.

No voting is required if the trustees are only required to give their counsel.

- The pastor may execute any acts of extraordinary administration only after consulting with the two lay trustees on the executive committee and obtaining the consent of the ordinary.

This consent is always required for validity (c. 1281).

With respect to civil law, these actions are undertaken by the full board of directors.

- An act of extraordinary administration should originate on the local level with the consultation of the executive committee by the pastor.

After discussing the proposed action, it should be brought to the full board, including the vicar general and the diocesan bishop.

The consent of the diocesan bishop, or in his absence the consent of the vicar general, is required before the action can go forward.

With respect to civil law, a majority of three of the five members of the board must concur for the resolution to be approved.

- It should be noted that the actions of the lay trustees as described in the executive committee are only advisory.

However, in a formal action that goes before the entire board, the civil law will likely require the each member have a deliberative vote.

Even so, the two lay trustees compose a minority of the board.

An action can go forward according to the requirements of civil law with the consent of the diocesan bishop, the vicar general, and the pastor.

- The rules governing the executive committee should not be crafted in such a way that the two lay trustees can initiate an action of the parish corporation contrary to the wishes of the pastor and outvote him (2-1).

Role of the lay trustees

- The rights and responsibilities of the two lay trustees should be clarified.

The executive committee should meet on a regular basis.

- The trustees should be informed of the financial status of the parish.

The trustees should sign any financial report of the parish.{12}

- The trustees should have some role in preparing and reviewing the parish budget.{13}

The trustees should also have some role in the preparation of a financial report to the parish.{14}

- The counsel of the trustees should be sought before undertaking any act of extraordinary administration and before undertaking some acts of alienation.

The trustees should have the right to be fully informed about the proposed action before giving their recommendation.{15}

- It would be appropriate for the pastor and parish trustees to be ex officio members of all major parochial bodies, such as the finance council and the pastoral council and school commission if they exist.

The trustees may be given the right to attend the meetings of other parochial bodies, although they may not want to be bound by attending every meeting that takes place in a parish.

- As a side note, these parochial bodies (the finance council, pastoral council, school commission, etc.) are not separate juridic persons.

They should be described in the parish statutes, at least in a general way, even if they develop their own sets of rules of order for their meetings.

Actions of the board of directors

- The diocesan bishop must reserve the right to initiate certain actions, even against the wishes of the pastor or the parish.

Therefore, these actions must be reserved to the full board of directors.

Each of these actions is governed by requirements in canon law that must be observed by the diocesan bishop.

These include the following actions:

- To create and suppress a parish (c. 515 §2)

- To appoint the pastor (c. 523)

- To remove the pastor (c. 538 §1)

- To impose a tax on the parish (c. 1263)

- To order a special collection (c. 1266)

- To intervene in the case of negligence (c. 1279 §1)

- The diocesan bishop always retains the right to intervene in matters of faith and morals.

- The parish is also accountable to the diocesan bishop in certain respects.

In this respect, the parish is accountable to the full board of directors in the following matters.

- To order the administration of temporal goods through financial policies (c. 1276 §2)

- To exercise vigilance over the parish (c. 1276 §1)

- To receive an annual report (c. 1287 §1)

What constitutes extraordinary administration?

- Some matters should be defined as acts of extraordinary administration.

These acts require the consent of the ordinary and are therefore reserved to the full board of directors and not simply the executive committee (c. 1281 §§1 and 2).

- Some matters that should be reserved as extraordinary administration include:

- Expending assets in excess of a defined amount.

(Certain large but regular expenses may be exempted, such as making ordinary payroll for large parishes.)

- Expending assets in any amount when a standing debt will be incurred.

- Borrowing money.

- Buying or selling property.

- Leasing or mortgaging assets.

- Promising assets as collateral or surety.

- Erecting or demolishing a building.

- Changing the location of the parish office or parish rectory.

- Establishing a foundation or other legal entity.

- Entering into a contract on behalf of the parish.

(Certain agreements for ordinary and on-going services may be exempted, such as phone service contracts, lawn care, pest control, equipment service agreements, etc.

Accounts that involve a simple promise-to-pay for services rendered may also be exempted, such as establishing a charge account at a local business.)

- The long term investment of assets.

The amount of assets and the length of time must be defined.{16}

- Alienating assets in excess of a defined amount.

- Accepting a gift burdened with modal obligations (c. 1267).

- Initiating or contesting litigation (c. 1288).

- The financial transactions that are extraordinary administration should not be the same from parish to parish.

What constitutes ordinary administration of greater importance?

- It has been suggested that canon 1277 can be used as a model to create an additional level of acts of administration.

Acts of ordinary administration of greater importance would be considered less significant that the extraordinary acts of administration described above.

These acts do not require the consent of the ordinary.

They may, however, require consultation with the lay trustees.

These actions are therefore considered to belong to the executive committee of the parish.

- It may be appropriate to consult the parish finance council in the matters that require the consultation of the lay trustees.

- Some of the matters that should be considered as acts of ordinary administration of greater importance include:

- The establishment of a budget.

- Renovating an existing building.

- Expending assets in excess of a defined amount, which is less than the limit for extraordinary administration.

- Any of the above items in the previous section that are not listed as extraordinary administration should be considered as acts of ordinary administration of greater importance.

- For any act that is extraordinary administration when above a certain amount, the same act may be considered an act of ordinary administration of greater importance when above a lesser amount.

- If the consultation with the parish trustees should be required for validity, this requirement must be expressly stated (c. 10).

Parochial assets

- Any parochial assets that are on deposit through a diocesan fund of any kind should still be considered assets of the parish.

These assets should be listed on parish reports.

Financial clarity is this matter of ownership is essential.

- The parish should have a right to withdraw those assets, although the normal limits on acts of extraordinary administration still apply.

The diocese has a right to maintain a reasonable oversight over financial management (c. 1276 §1).

- A "piercing" argument could be made if the diocese exercises a dominative control over the investment of parish assets through a mandatory diocesan fund.

This problem might be avoided if a diocese offers one or more pooled funds invested under the direction of the diocese, but also permits parishes to propose a separate investment of funds.

Even so, any manner of investment proposed by a parish requires the approval of the diocesan bishop (c. 1284 §2 6º).

The possibility of an investment separate from the diocese will help defend against any "piercing" argument.

Special issues governing missions

- A mission is either a quasi parish (c. 516 §1) or another means of providing pastoral care (c. 516 §2).

- Missions should be separately incorporated.

A parish is a juridic person by the law itself (c. 515 §3).

However, a mission must be made a public juridic person by decree (c. 114 §1).

- A mission is generally treated like a parish.

However any exceptions to this rule must be spelled out in the statutes or the decree establishing the mission:

- A mission may not have the same right to stability that a parish has.

Is the suppression of a mission different from that of a parish (c. 515 §§1 and 2)?

- What happens to the assets of a mission when it is suppressed (c. 123)?

Observations for the State of Illinois

- Under the Illinois Religious Corporation Act (805 ILCS 110/), a parish is very easily incorporated as an individual and separate entity within a diocese.

The language of incorporation should be carefully studied to examine the parish-to-diocese relationship.

- It is particularly useful to note that a lay trustee is exempted from legal liability.

Illinois State law exempts any trustee who does not earn more than $5,000 per year from the parish (cf. 805 ILCS 110/47b).

II.

Other institutions in the diocese

Some other institutions may be at risk because they are not automatically separated by the code or by clear structures.

These institutions may include diocesan high schools, Newman centers, hospitals, cemeteries, and other diocesan institutions.

These institutions should be separately incorporated, erected as a juridic person, and should have their own statutes that are tailored to their specific situation.

The general observations made earlier should be applied to these institutions with some of the following adaptations.

The fundamental issue of diocesan control is at the heart of the matter.

Diocesan high schools

The following is one possible model for erecting a diocesan high school.

- A pastor's board should be composed of those pastors of the supporting parishes of the high school.

A supporting parish is any parish within a reasonable distance of the high school so that students from that parish may attend.

It is for the diocesan bishop to determine which parishes are supporting parishes for a high school.

Supporting parishes may be assessed for the support of the high school.

- The pastor's board selects persons on the local level to compose the school board.

While the pastors do not have the time (or sometimes the ability) to run the day to day details of a high school, the members of the school board should be chosen because of their knowledge and ability to help run the details of the high school.

- A self-selected portion of the pastor's board should sit on the school board.

These pastors may be called the pastor's executive committee.

- Ordinary acts of administration should rest with the principal.

- Certain ordinary acts of administration of greater importance should be reserved to the school board or the pastor's board.

A significant part of the duties of the pastor's board is financial oversight.

Because the local pastors have a responsibility for contributing to the high school, they have a natural interest in insuring its financial viability.

Some actions to reserve to the pastor's board include:

- The approval of the budget.

- The hiring of the principal.

- The approval of certain expenditures.

- The diocese should consider retaining control over the following actions for a high school:

- Before hiring a principal, the diocesan school's office reviews the qualifications of the proposed principal and the diocesan bishop gives his approval.

- The diocesan bishop confirms the election of the president of the pastor's board.

- The diocesan bishop approves any changes to the statutes that govern a diocesan high school.

- The diocesan school's office issues educational policies that govern every school in the diocese and which must be observed.

- The diocesan school's office visits each school every year.

- Each school must submit a financial report to the diocesan school's office.

- All teachers' contracts are signed by one or more of the following:

the principal, the president of the pastor's board, and the diocesan bishop.

- The diocesan bishop has the right to intervene in matters of faith and morals.

- The decision to dissolve the high school should rest with the diocesan bishop, although the statutes could make provision for this action to be initiated by the pastors of the pastor's board.

- Reasons should be given that could result in the removal of the president of the pastor's board or the principal from office.

The diocesan bishop should be able to exercise this prerogative in an exceptional case.

- Extraordinary financial transactions should be clearly defined.

These transactions require the consent of the ordinary, whether the diocesan bishop or vicar general.

- All transactions, including extraordinary transactions, should be initiated on the local level through the school board or the pastor's board.

- Ordinary transactions which are large, such as payroll, should be exempt from any required permission on the part of the diocese.

- A claim of ownership should be made, that the assets of the high school belong to the high school itself and not the diocese.

- The statutes must address what happens to the assets of a dissolved high school.

To avoid a piercing argument, the assets should not revert directly to the diocese, but might be dedicated to Catholic education in the diocese.

The pastor's board might recommend the division of assets, subject to the bishop's approval.

Other institutions

Any diocesan Newman centers, hospitals, and cemeteries should have their own board and statutes.

It is important to determine an appropriate way for decisions to be made on a local level regarding the selection of board members and the administration of financial assets.

III.

Pooled Assets Held by the Diocese:

Diocesan Foundations

Other special consideration should be given to any pooled funds held by the diocese but which are set aside for a special purpose.

The following factors should be considered:

- Does each fund have its own statutes and its own independent board of directors?

- Has it been established as a separate corporation and a public juridic person?

- It is probable that several diocesan officials are on the board, including the diocesan bishop and the vicar general.

However, are the majority of the members of the board independent from the bishop?

- Are the statutes and board of directors unique to the institution?

A cookie- cutter set of by-laws or a rubber-stamp board of directors exposes those funds to possible risk.

- Do the statutes make an explicit claim of ownership separate and independent from the diocese?

- Does each fund have a clear purpose?

- How easy is it to use some of the assets of each fund for another purpose?

The more the assets are unalterably dedicated to a fixed purpose, the less likely they are to be exposed by a "piercing" argument.

- Who selects the membership of each board?

If board members are selected in an independent manner rather than by appointment of the diocesan bishop, the fund would be more considered independent from the diocese.

- Who initiates corporate action?

The less the diocesan bishop has independent control over the funds, the less likely the fund would be considered independent.

- What actions are considered ordinary and extraordinary administration?

- In what ways is the fund accountable to the diocesan bishop and to other persons?

- What actions are reserved to the diocesan bishop?

Some items can and should include:

- The approval of board members, or at least the right to give a nihil obstat.

- The approval of extraordinary acts of alienation.

- The suppression of the fund.

- The removal of the administrator of the fund.

- The right to receive an annual report.

Some examples of these funds might include:

- A priest's retirement fund

- This fund may hold monies contributed from the parishes to help priests in their retirement.

Oversight could rest with the presbyteral council and individual priests of the diocese elected by their brother priests.

Extraordinary administration requiring the approval of the diocesan bishop could include changing the investment strategy of these funds or adjusting the table of benefits paid to retired priests.

- Parish investment fund

- This fund may be composed of the surplus assets of many parishes which can be loaned to other parishes in need.

Those investing may receive a greater interest rate than most banks while those borrowing may receive a lower rate than otherwise available.

Oversight should rest with the presbyteral council, individual pastors elected from their brother pastors.

This fund should be closely monitored by the diocesan finance council.

Extraordinary administration could include changing the interest rates for funds on deposit or funds on loan.

These assets are the property of the contributing parishes.

- This kind of fund will likely have more assets than the cumulative sum of all the deposits and loans of each parish, because the interest received on a loan should be slightly higher than the interest paid on deposit.

This margin is necessary because the monies in the fund will never be fully loaned out, and the investment of the liquid assets may incur some administrative expenses.

One may ask who owns whatever surplus remains beyond the deposits and loans of each parish?

Nevertheless, a "piercing" argument is avoided if the funds themselves are entirely separated from the diocese.

If the surplus becomes too large, the interest rates should be modified to pay more on deposits and charge less on loans, thus returning the surplus to the parishes.

- Endowment fund

- This fund may be composed of pooled funds from various institutions invested in the stock market using a conservative investment strategy.

Oversight should rest with the presbyteral council, the diocesan education commission and the finance council.

These assets are the property of the contributing schools and institutions.

Any financial expenses for the administration of this fund should be borne by the institutions contributing to the fund.

There should be no surplus owned by the diocese.

In this way, 100% of the funds belong to the contributing parishes and institutions.

{1} The code directs administrators of temporal goods to protect those goods by civilly valid methods (c. 1284 §2 2º).

{2} For the purposes of this essay, all the juridic persons described will be presumed to be public.

Public juridic persons are more closely governed by ecclesiastical authority in a diocese and act more directly in the name of the Church (c. 116 § 1).

Private juridic persons in a diocese tend to be autonomous and are not likely to be the target of a "piercing" argument.

{3} A public juridic person is always created by some act of the competent ecclesiastical authority (c. 116 §1).

The juridic personality is either conferred by the law itself at the time the entity is erected by competent ecclesiastical authority, or by the decree of the competent ecclesiastical authority (c. 116 §2).

{4} A public juridic person may be suppressed by competent ecclesiastical authority, or by inactivity for one hundred years (c. 120 §1).

It is appropriate for the statutes to address reasons that might lead to dissolution.

Nevertheless, the public juridic person may not dissolve itself; it may recommend to competent ecclesiastical authority that it be suppressed.

{5} The diocesan bishop has the right to tax a public juridic person, in proportion to its income, for the needs of the diocese after consulting with the diocesan finance council and the presbyteral council (c. 1263).

{6} The ordinary retains the right to intervene in the case of the negligence of an administrator (c. 1279 §1).

The ordinary also has the right to appoint a temporary administrator of a public juridic person when no administrator is provided by law (c. 1279 § 2).

In general, the ecclesiastical authority that erects an office has the right to provide for that office (c. 148).

Unless otherwise specified, the diocesan bishop freely appoints persons to ecclesiastical offices in his diocese (c. 157).

In general, the one who appoints a person to an office has the power to remove that person (c. 193 §3).

The circumstances of the juridic person must be weighed when determining if the diocesan bishop can or should retain the right to appoint or remove the administrator.

{7} Administrators invalidly place acts that exceed the limits and the manner of ordinary administration unless a faculty from the ordinary has been obtained.

The acts of extraordinary administration are to be defined in the statutes (c. 1281 §§1 and 2).

{8} The diocesan bishop is required to hear his finance council and college of consultors in order to place actions of administration that are of greater importance (c. 1277).

This provision of the law can be applied analogously to other juridic persons

{9} It may be sufficient to cite a few canons.

The bishop, vicar general and the pastor are appointed for an indefinite period of time unless, in the case of a pastor, he serves only for a term (cc. 477 §1 and 522).

{10} It may be sufficient to cite a few canons.

The diocesan bishop loses office when the Holy Father accepts his resignation, transfers him or removes him in accord with the norm of law (cc. 184 §1 and 401).

The vicar general loses office when removed by the diocesan bishop (c. 477 §1).

The pastor loses office when the diocesan bishop transfers or removes him or when he accepts his resignation in accord with the norm of law (c. 538 §1).

A diocese whose pastors have terms should also add the loss of office by the lapse of a term (c. 522).

{11} This level of administration borrows the concepts of canon 1277.

The consultation of the two lay trustees is only required for validity if it is expressly stated in the statutes (c. 10).

{12} A financial report must be submitted to the local ordinary by each parish (c. 1287 § 1).

{13} A budget is strongly recommended for a parish.

Particular law can require each parish to prepare a budget and can determine the rules that govern the preparation of this budget (c. 1284 §3).

{14} Pastors of parishes are obligated to present a financial report to the parishioners (c. 1287 §2).

{15} Before the diocesan finance council and college of consultors give their advice to the diocesan bishop in an act of alienation, those persons are to be thoroughly informed both of the economic state of the juridic person in question, and of any previous acts of alienation (c. 1292 §4).

By extension, it is reasonable to require that the parish lay trustees be similarly informed before offering their counsel.

{16} The code requires the consent of the ordinary for these long term investments (c. 1284 §2 6º).

A long term investment would generally be funds invested for more than one or perhaps two years.

Parish corporate structure

Parish corporate structure